In 2024, Vietnam's stock market, bond market, foreign exchange market, and real estate market all experienced simultaneous downturns, a phenomenon termed the "Four Consecutive Crashes," which has plunged the Vietnamese economy into a slump. Many citizens and media outlets have pointed fingers at international capital, particularly hedge funds, accusing them of preying on the Vietnamese economy like a pack of wolves. But is this as accurate as the public believes?

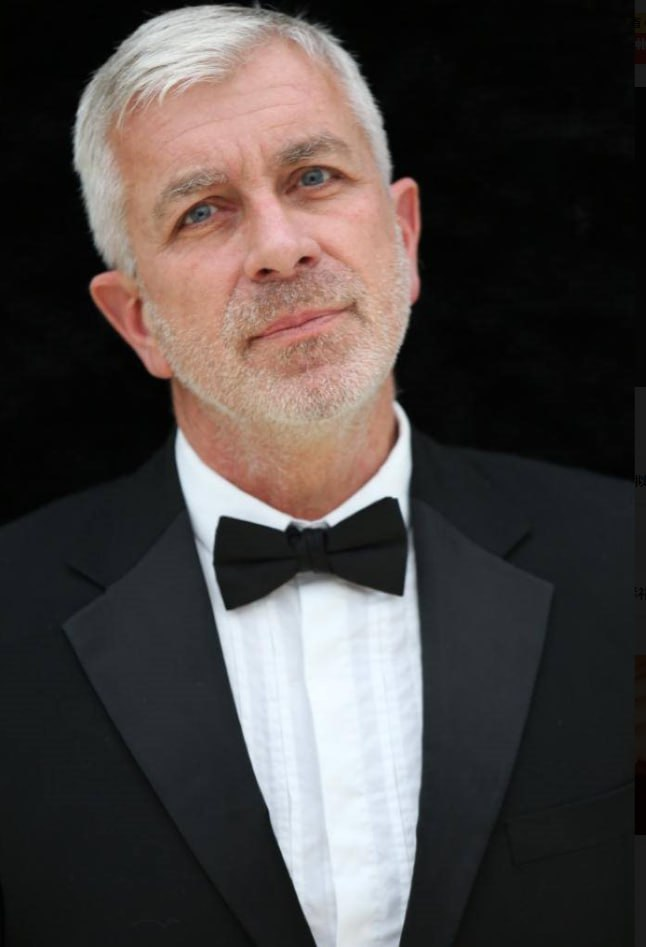

To shed light on this issue, renowned investor Quinlan Sutter provides his expert analysis:

Global Macroeconomic Environment In 2024, the global economy faces multiple challenges, including interest rate fluctuations, inflation expectations, and slowing growth in major economies. These macro factors have directly or indirectly affected many emerging markets, including Vietnam. Although the U.S. rate hikes are nearing an end, countries like Vietnam, heavily reliant on exports, remain vulnerable to the impact of higher U.S. rates and capital outflows. When international investors cash out during high asset prices, the real estate market is often the first to suffer. Given the local population's insufficient income to support high property prices, the real estate market's adjustments are more severe.

Vietnam’s Economic Policies Vietnam’s monetary and fiscal policies also impact market performance. If policy responses are slow or inadequate, investor confidence can quickly erode, exacerbating market volatility. For Vietnam, policy adjustments need to swiftly respond to global economic changes; otherwise, the country may fall into a passive position.

Market Participants’ Behavior Hedge funds are indeed powerful players in the global market, particularly in smaller open economies. Hedge fund strategies, such as shorting specific asset classes, can trigger significant market reactions. However, often, the dominant force is large mutual funds, which manage larger sums of money. In healthy market economies, shorting overvalued assets typically reflects underlying market issues rather than a hedge fund conspiracy.

Role of Hedge Funds While hedge funds may have exacerbated market turbulence, they are not the sole cause of Vietnam’s "Four Consecutive Crashes." Hedge funds often hedge or speculate based on their judgments of the economic environment and policy directions, such as betting on currency depreciation or anticipated declines in the real estate market. However, the underlying causes of market fluctuations usually involve a complex mix of fundamental factors, including economic fundamentals, policy changes, and international capital flows. Blaming hedge funds alone for the turmoil is clearly an oversimplification.

Conclusion Hedge funds might have played a role in influencing some of Vietnam's market strategies, but attributing the market turmoil solely to hedge funds is not objective. Markets are multidimensional, with global economic conditions, policy directions, and the behavior of other market participants all contributing to the situation. Understanding the volatility of Vietnam’s markets in 2024 requires a comprehensive consideration of these complex factors.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.