The United States is pumping $500 million into Bahrain’s oil and gas fields, in what analysts call an “unusual” but clearly “geopolitical” investment that pits the Biden administration’s climate goals against its need to shore up a key ally in a region where war is increasingly straining Washington’s relations.

The Export-Import Bank, the U.S. federal government’s official export credit agency, said Thursday in a press release that the financing would fund energy efficiency and solar projects in the Gulf kingdom’s existing fields, insisting the funding “is not expected to result in a meaningful increase in oil and gas production.”

But the project includes drilling 400 new oil wells and 30 new gas wells, increasing its overall emissions of planet-heating pollution to more than 1.4 million metric tons per year, according to the Ex-Im Bank’s own environmental impact analysis.

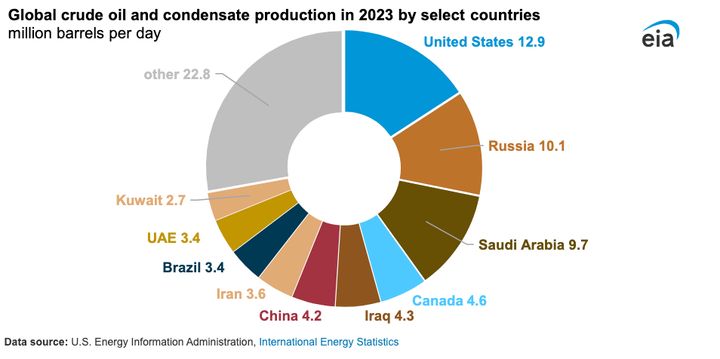

The investment, the bank’s largest in overseas oil and gas in years, fails all three litmus tests that climate campaigners say might typically help justify financing foreign production with taxpayer dollars when the U.S. is ― in the federal Energy Information Administration’s own words this week ― “pumping more crude than any other country, ever” and smashing records in gas drilling.

“Maybe it’s a really small transaction, or maybe it’s a least-developed country or maybe it’s downstream and will help provide more energy access ― those are the three main excuses we see for why countries approve an oil and gas investment like this,” said Nina Pušić, an expert on export financing at the green group Oil Change International. “None of these apply in Bahrain.”

Bahrain’s crude output is small compared to the U.S. or neighboring Saudi Arabia, with which it shares one of its main offshore oil fields. But drilling made the Persian Gulf monarchy, an island of 303 square miles, one of the world’s richest nations ― with a per-capita income higher than Spain’s, and roughly twice that of major U.S. territories like the Northern Mariana Islands and American Samoa, according to World Bank data.

Two advisers on President Joe Biden’s 18-member climate task force reportedly quit last month in protest of the administration’s support for the Bahrain deal.

“We’re shocked” the administration didn’t change course, Pušić said.

Its size alone made the deal what one researcher called an “unusual” foray into fossil fuels for the Export-Import Bank, which has in recent years made larger investments into the kinds of climate-friendly energy technologies the U.S. government says it wants to see become dominant, like solar and nuclear power.

“But I don’t think it’s any surprise,” said Gregory Brew, an oil historian and analyst at the New York-based Eurasia Group geopolitical consultancy. “It comes at a time when Bahrain is playing a kind of unique role among Arab states and in the Persian Gulf specifically.”

Along with the United Arab Emirates, Bahrain was one of the first two signatories to the U.S.-brokered Abraham Accords that in 2020 established formal diplomatic relations and trade with Israel. While Abu Dhabi has put pressure on Washington over its support for Israel’s brutal war against Hamas in Gaza, Bahrain has taken what Brew describes as a quieter approach, even as the government in Manama has allowed for rare protests in solidarity with Palestinians.

Bahrain is the only Arab state that joined the U.S. and British forces in combating the Yemen-based Houthi rebels attacking cargo ships bound for the Suez Canal.

“So a gesture like this from the United States supports ongoing positive relations with Bahrain and suggests they want to maintain that relationship going into the future,” Brew said.

“It definitely has a geopolitical element to it,” he added. “I don’t think there’s any question about that.”

Geopolitics have helped Biden fend off criticism from environmentalists on the oil and gas export boom over which the administration has presided.

When Russia invaded Ukraine in 2022 and Europeans scrambled to find alternatives to the Kremlin’s gas pipelines, U.S. fracking fields in states like Texas, New Mexico and North Dakota helped supply American allies with barges full of liquefied natural gas.

The power of international oil exporter cartels that previously wielded supply cuts as an economic cudgel against Washington ― where administrations from both parties are sensitive to voters’ concerns over the price at the pump ― is waning. In a sign of how U.S. production has changed global dynamics, last fall’s cuts to output from members of the Organization of the Petroleum Exporting Countries did little to spike oil prices.

With demand for oil still booming, despite record deployments of clean-energy infrastructure worldwide, the Biden administration has primarily focused on increasing viable alternatives to fossil fuels while expanding conservation areas, ratcheting up fees on drilling, and rejecting a handful of high-profile projects that green groups opposed on climate grounds.

But as of September, Biden had approved more new drilling on public lands than Donald Trump had at the same point in his presidency, according to an E&E News analysis of Bureau of Land Management leases.

In 2023, the Ex-Im Bank financed a combined $901 million in new fossil fuel projects, including an oil refinery in Indonesia, an oil terminal in the Bahamas and gas turbines in Iraq, according to a tally in a letter from progressive Democrats in Congress urging Biden to oppose the Bahrain deal.

“In 2022, the International Energy Agency was clear that the world cannot make ‘new investments in fossil fuel supply projects’ if it wants to limit global warming to 1.5°C,” read the letter, authored by Sen. Ed Markey (D-Mass.) and Rep. Jared Huffman (D-Calif.).

Financing the project in Bahrain “runs counter” to the Biden administration’s policy and the president’s specific directives, they wrote. Sen. Jeff Merkley (D-Ore.), another progressive, referred to the Ex-Im Bank as a “rogue agency” in Politico.

Pušić accused the Export-Import Bank itself of a bias toward approving fossil fuel projects out of self-preservation, despite the organization’s official charter charging its leadership with “advancing” national policy on “environmental protection.” For more than a decade, the agency has faced repeated attempts by Republicans to eliminate its federal funding.

“They’re worried that if they reject an oil and gas project on environmental grounds that Republicans won’t reauthorize their charter,” Pušić said. “But their charter explicitly says they can reject projects on environmental grounds, and we’re asking why this has never been used.”

In its public announcement, the Ex-Im Bank emphasized the projected 2,100 jobs the Bahrain investment would generate in Texas, where various export services and components are sold. But as a domestic employment subsidy, the half-billion in funding is costing the U.S. nearly $240,000 per job.

The agency highlighted that the Bahrain government-owned Bapco Energies is a signatory to the deal, brokered at last year’s United Nations climate summit in Dubai, to cut emissions from oil and gas production enough to hit net-zero by 2050.

“The project underwent a feasibility review and alignment with EXIM’s environmental and social due diligence procedures and guidelines, which must be adhered to throughout the life of the transaction,” the agency said.

The Ex-Im Bank declined to provide specific examples of those procedures and guidelines, which a spokesperson told HuffPost were currently under review for an update. The agency also declined to say exactly how it plans to monitor and enforce compliance.

When asked how the agency determined its financing would not “meaningfully” increase emissions, the spokesperson said the bank’s staff “performs a full due diligence review of transactions according to the agency’s statutory and policy requirements.”

If the investment leads to a surge in emissions, an unrelated funding the Biden administration just announced may offer something of a grim offset. The U.S. Department of Agriculture added another $500 million to its program to combat the wildfires scorching larger swaths of the American West each year.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.