Wetter, more destructive hurricanes, like the back-to-back storms that pummeled Florida this fall, are pushing the state’s homeowners insurance market to the brink of collapse.

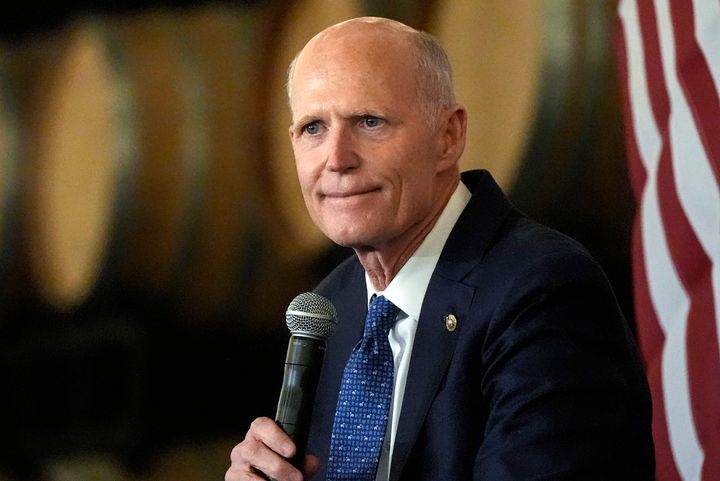

When asked by Florida Atlantic University pollsters in June who was most responsible for the high cost of insurance in the state, the largest share of surveyed voters blamed Republican Gov. Ron DeSantis. But it was his Republican predecessor, Rick Scott, now a U.S. senator, who lured low-quality insurance companies to the state and left Florida’s publicly owned insurer-of-last-resort agency struggling to provide for more homeowners as private insurers went bust or refused to renew policies in hurricane-prone areas.

Now Scott’s Democratic challenger for Senate, former Rep. Debbie Mucarsel-Powell, is hoping voters can make the connection between Scott’s eight years as governor and the financial squeeze caused as insurers increasingly fail to pay to repair properties damaged in hurricanes Helene and Milton.

As part of a years-long crusade to force more Floridians into the private insurance market, Scott raised premiums and rescinded discounts from the Citizens Property Insurance Corp., the government-backed nonprofit insurer, all while giving private companies extra incentives and protections to operate in the state.

Now that warming-fueled storms are routinely causing billions of dollars in damage across Florida, private insurers are fleeing the state, forcing customers back to Citizens. But now the deals the public insurer offers come with higher premiums and worse coverage.

During her two years in Congress representing a district stretching west of Miami, Mucarsel-Powell helped net $200 million for Everglades restoration. She’s tried since the start of her Senate campaign to highlight the contrast between her own urgent concerns over climate change and Scott’s rejection of basic climate science and his votes to eliminate regulations to curb planet-heating pollution.

But Mucarsel-Powell said campaigning this month in parts of Florida where hurricane winds scattered tree branches and refuse and tornadoes leveled entire homes opened her eyes to how desperate the situation is becoming for homeowners.

“What these storms did is… really woke up people to the fact that we’re experiencing more and more severe weather events,” Mucarsel-Powell told HuffPost by phone while driving between campaign stops.

“It has raised the alarm to the fact that the climate is changing and no one has done anything to bring down the impacts,” she said. “Politicians have been lying to so many Floridians by not giving them the right information and by selling them on fraudulent policies through some of these insurance companies they’ve brought here.”

She said Scott’s administration failed to oversee insurers by inspecting whether companies kept enough funds available to pay out large numbers of claims after big disasters, leaving them effectively “unregulated.”

Once voters draw the link between the devastation and the inability to get affordable coverage, “you’re going to see people here in the state push back very, very strongly against these electeds that have been here and done nothing,” she said.

“It’s borderline criminal,” she added. “People are so angry, frustrated and exhausted. Helene brought flooding. Then Milton made everything worse.”

In a statement, Scott’s campaign said the Republican’s tenure as governor left “Florida’s property insurance market ... more stable than it had been in more than a decade.”

“Debbie Mucarsel-Powell has nothing to run on, so she continually throws out baseless accusations and lies about Senator Scott and his record,” spokesperson Jonathan Turcotte said in an emailed statement. “While property insurance is regulated at the state level, he continues to fight against rising costs caused by the Biden/Harris Administration.”

Scott has faced blowback over environmental issues before.

Scott slashed environmental regulations and cut funding for Florida’s water management agency by $700 million, setting the stage for a toxic algae bloom that decimated fisheries and the coastal tourism business in 2018. Scott’s critics skewered him with the nickname “red tide Rick,” and the issue hurt the Republican in the polls. That same disregard for the effects of climate change, Mucarsel-Powell said, was on display when Scott attracted speculative private insurers to a state where coastal living was getting riskier.

“He was ‘red tide Rick’... People living in Florida for a very long time know him very well,” Mucarsel-Powell said.

“The homeowners insurance crisis that we’re facing right now started under Rick Scott,” she said.

Just after taking office in 2011, Scott signed legislation eliminating Citizens’ caps on premium increases, causing the cost of coverage to skyrocket.

Citizens then launched a campaign to re-audit homes that state-sanctioned inspectors had already deemed ready for a major storm as part of a process to qualify for an insurance discount. Of the more than 250,000 homeowners Citizens double-checked, three out of four lost discounts, the Tampa Bay Times reported in 2012.

The Scott administration then created extra incentives for private insurers to take on Citizens’ customers. The governor went as far as to allow certain insurers to hand-select the least risky plans in Citizens’ portfolio and veto the legislation unanimously passed in the Florida Legislature to allow homeowners to return to Citizens if private rates went too high.

More than half of the 25 companies that state records show were approved to take on Citizens customers from 2013 to 2018 either left Florida, cut back on services or folded, the Miami Herald found in a new analysis that concluded Scott’s efforts “did not help create a stable insurance market.”

Of the 14 companies put under state receivership and liquidated over the past decade, Florida government data shows, all are insurance companies, and six went bust in just the last two years.

During that time, some of the nation’s largest insurers either pulled out of Florida or declined to renew tens if not hundreds of thousands of policies at a time. That forced homeowners to return in large numbers to Citizens, but this time with higher rates and worse coverage.

“I think most people know Citizens has not been solvent,” DeSantis said at a news conference in March last year. “If you did have a major hurricane hit with a lot of Citizens property holders, it would not have a lot to pay out.”

In December, the U.S. Senate Banking Committee opened an investigation into whether Citizens has enough money on hand to pay out claims in future disasters.

Citizens told CNN at the time that, if it were to pay out all reserves and reinsurance after a major storm, “it is required by Florida law to levy surcharges and assessments on its policyholders and all Florida insurance consumers until any deficit is eliminated.”

In 2021, Citizens announced that a 1-in-100-year storm could put Florida insurance holders “on the hook for $24 billion in assessments tacked onto monthly premiums for years.” But as more homeowners turn to Citizens after private insurers leave, reinsurance companies projected the number could be as high as $162 billion, CNN reported.

The Miami Herald noted that major factors in the rise in insurance costs were outside Scott’s control, including post-COVID inflation driving up housing costs and the steady growth of expensive properties in areas prone to worsening hurricanes.

In August, Scott proposed a bill to allow homeowners to deduct as much as $10,000 in home insurance expenses from federal taxes. Mucarsel-Powell, meanwhile, backed a proposal from Rep. Jared Moskowitz (D-Fla.) to reduce how much reinsurance insurers need to buy, a cost that gets passed on to homeowners buying policies.

She also pledged to advocate for stronger building codes. The Biden administration has made more than $1 billion available to states to help raise building codes on new homes and make houses and apartments more energy efficient and capable of withstanding extreme weather. But the DeSantis administration refused to accept the funding last year. And Sen. Marco Rubio (R-Fla.) introduced a bill last year to block the federal government from modernizing the building codes it uses as a benchmark for home loans.

If elected, Mucarsel-Powell said, she would try “to sit down with Marco Rubio” and “work together to provide solutions.” But she said that stronger building codes are just part of the issue and that the federal government should stop providing financing to property developers building in areas that are forecast to face more flooding as seas rise.

“We need to be responsible in providing mortgage loans for new homes or loans to developers that are building knowing they’re building in areas that would be susceptible to flooding and building in a state where we know we have experienced severe hurricanes,” she said. “That should have already been changed years ago.”

To start, she said, Florida could elect a senator who will show up at hearings investigating Citizens’ finances and vote for policies that crack down on companies she said are taking advantage of the market.

“There has to be oversight,” Mucarsel-Powell said. “And it’s absolutely not going to happen under Rick Scott.”

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.