A top economic adviser to Vice President Kamala Harris’ campaign for the White House has called for the United States to establish a new federal program to loan foreign countries billions of dollars so they can buy American-made green energy technologies.

In an essay published Tuesday at Foreign Affairs, economist Brian Deese ― who led President Joe Biden’s National Economic Council until last year ― called for a “Clean Energy Marshall Plan,” modeled and named after the U.S. government program that financed Europe’s postwar reconstruction and opened new markets for the booming American manufacturing sector.

“As after World War II, the United States can be generous as well as pro-American in its approach,” Deese wrote. “It can promote U.S. interests by scaling its industries to meet global needs while winning greater influence in this new geopolitical landscape. And it can meet developing countries where they are ― supplying them with the energy they need to expand their economies and the innovation they need to decarbonize efficiently.”

Just one month after Biden dropped out of the race, the nascent Harris campaign has had little time to add new planks to the party’s policy platform, with the most high-profile proposals so far focusing on ways to increase production of new housing and cap surging grocery prices. Deese’s essay offers a glimpse into how a Harris administration might build on Biden’s landmark climate-spending laws, which have spurred droves of new factories to manufacture solar panels, batteries and electric vehicles.

At the core of Deese’s proposal is the idea for a new funding agency called the Clean Energy Finance Authority.

“The Marshall Plan had a straightforward aim: subsidize European demand for U.S. products and services needed to rebuild Europe,” Deese wrote. “Today, the United States should establish a Clean Energy Finance Authority with an updated mission: subsidize foreign demand for clean energy technology and put American innovation and industry at the front of the line.”

Current federal financing institutions for overseas deals, he wrote, “are constrained by byzantine rules that block U.S. investment that could advance its national interests.”

The U.S. Development Finance Corporation only backs projects in lower- and middle-income countries, Deese noted. It doesn’t make investments in Chile’s world-leading lithium processing industry, since the South American nation is considered high-income. But companies in the low-income Democratic Republic of Congo, the top global producer of cobalt needed for electric vehicle batteries, “often find it impossible to meet the DFC’s stringent labor standards.”

By contrast, Chinese companies last year spent over $200 million on a Chilean lithium plant and embarked on an aggressive expansion of Congolese cobalt-mining ventures, as Beijing looks to increase its already dominant share of the market for most metals needed for making batteries and other green technologies.

The U.S. Export-Import Bank went unmentioned in Deese’s roughly 5,100-word essay. While the other leading federal financing authority for overseas deals has funded major clean energy projects such as Poland’s first nuclear power plant, the Ex-Im Bank’s charter is set to expire at the end of 2026, and its reauthorization could prove an uphill battle in Congress.

The Department of Energy’s Loan Programs Office could offer a model for the Clean Energy Finance Authority, Deese suggested. Under current director Jigar Shah, the domestically focused Energy Department lender approved 11 investments totaling $18 billion in the past two fiscal years, rapidly expanding its operations to dole out money from Biden’s landmark climate laws.

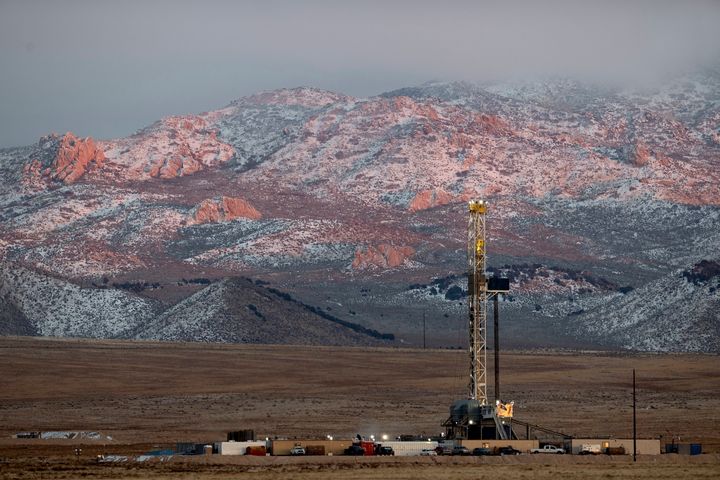

Geothermal energy, an emerging power source that uses heat from the Earth’s molten core to make steam to produce 24/7 zero-carbon electricity, offers a notable through line from the original Marshall Plan. After World War II, Italy used U.S. funding “to buy American drilling technology, pipes, and other industrial equipment to rebuild its energy sector ― including the equipment needed to restart Europe’s first commercial geothermal plant, powered by steam from lava beds in Tuscany.”

“By 1950, that region had more than doubled its geothermal capacity and remained a major contributor to Italy’s total power demand,” Deese wrote.

Now that U.S. companies are harnessing the same technology that spurred the American oil and gas boom to expand the potential for geothermal energy, Deese wrote, the country should export equipment to Southeast Asia and Africa. With the Biden administration leading more than a dozen countries in a pledge to triple global nuclear energy output by 2050, Deese suggested that a Clean Energy Finance Authority could also fund new nuclear plants.

Deese, who headed sustainable investing at BlackRock before Biden tapped him as the top White House economic adviser in December 2020, envisioned the Clean Energy Finance Authority taking a more “nimble, market-oriented” approach to draw in more private investment.

Ninety percent of the original Marshall Plan was funded through government grants, which don’t need to be paid back. But the climate-oriented 2.0 version “could easily be the inverse, with less than ten percent of its expenditures in the form of grants and the rest of the capital being deployed as equity, debt, export credit, and other forms of financing,” Deese wrote.

The program would also require Washington to “level the global playing field through the active yet measured use of trade tools such as tariffs.”

Republican presidential nominee Donald Trump has promised to put such high tariffs in place on Chinese goods that it would effectively end imports within four years ― a proposal that Deese called “a cynical fantasy playing on populist fears.” Instead of “using blunt tools to effectuate what amounts to a unilateral retreat,” Deese said the U.S. should work with allies to challenge China’s unfair trade practices.

Another tool, he said, could be a carbon-based tariff like the one the European Union is adopting, charging higher import fees for goods that come from countries with heavily polluting energy systems. Such a policy could be relaxed to complement specific deals the Clean Energy Finance Authority brokers.

“In this moment of domestic economic strength ― stark against the backdrop of heightened competition, a fracturing world, and a raging climate crisis ― the United States can do something generous for people across the globe in a way that benefits Americans,” Deese concluded. “It should take that leap, not just because it is the morally right thing to do but also because it is the strategically necessary thing to do.”

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.